Private Money Lenders | Hard Money Loans in Arizona

Incredible landscapes and national parks are not the only things Arizona is known for. The Grand Canyon State offers much more to its residents. With excellent living standards and a booming local economy, Arizona offers many investment opportunities for real estate investors.

As an aspiring property developer or investor, you need to secure an external funding source for your ambitious projects. Whether you’re flipping a distressed property or building a new one from scratch, securing a loan can be highly beneficial.

Learn how Insula Capital Group’s specialized loan programs can help you kick-start your next real estate project.

Work with Reliable Hard Money Lenders in Arizona

Private lending and hard money lending are two of the best options for a real estate investor. Both options relieve the financial stress that can be a big concern during your project. The type of funding program you require depends on the unique specifications of your real estate project. That’s why it’s crucial to work with a private lending or hard money lending company that can curate a suitable loan plan for you.

Insula Capital Group has served the US real estate market for over 30 years. We offer multiple loan programs in Arizona that are designed specifically for real estate investors. You can enlist the help of our highly experienced and skilled underwriters for any property loan. We offer new construction loans, fix & flip loans, residential rental loans, and multifamily/mixed-use loans.

What Makes Hard Money Loans Great For Your Project

From quick approvals to incomparable flexibility, hard money loans stand out in many ways. Unlike traditional loans, hard money loans don’t have a lengthy approval process, and therefore, these can get you the funds you need quickly during time-sensitive projects.

Moreover, as hard money lenders, we’re more flexible than traditional institutions, and you don’t necessarily need a high credit score to qualify for a loan—we prioritize the collateral’s value.

And, of course, with a hard money loan, you can finance projects that may generally look too high-risk—they’re definitely a great way to take up opportunities that may seem out of reach.

Arizona’s Real Estate Market Insights

Planning to invest in Arizona’s real estate market soon? Keep the following statistics in mind for excellent decisions!

- Population: 7.276 million

- Median Household Income: $72,581

- Migration Rate (into Arizona): 57%

- Unemployment Rate: 3.60%

- Total Properties Listed: 31,642

- Median Sale Price: 435,500

- Annual Increase:4.6%

- Number of Homes Sold: 7339

- Average Days on Market: 41

- Number of Homes Sold Above List Price: 16.4%

- Interest Rate: 8.5%

- Sale-to-list price ratio: 98.1%

- Foreclosure rate: 1 in every 6316 homes

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

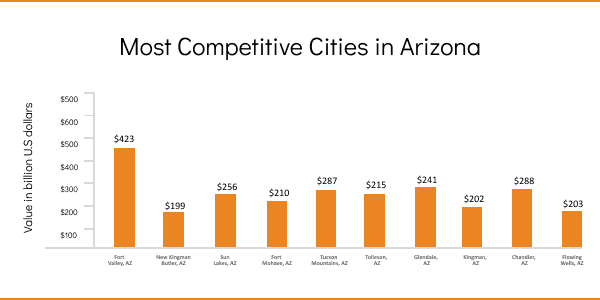

Why Invest In Arizona

It’s no secret that Arizona has a diverse and robust economy driven by the healthcare, tourism, and technology sectors. This essentially means there’s a constant influx of jobs and, therefore, people. Needless to say, these people moving into the state need a place to stay, which drives up the demand for housing!

Moreover, thanks to the great climate in Arizona, cities like Tucson and Phoenix are always attracting new residents who are looking for affordable housing. This population growth, combined with the limited housing supply, helps to swell propertyvalues and offers some incredible rental income potential.

It’s also worth keeping in mind that the state has a very pro-business environment and some amazing tax-friendly policies that further help investors, especially those investing in metropolitan areas.

And, of course, Arizona is known to be the ultimate spot for those looking to retire, and needless to say, more and more seniors are looking to buy homes in Arizona!

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Applying for a hard money loan in Arizona with Insula Capital Group involves a very straightforward process.

You will start by completing the online application form. Once submitted, the application will be reviewed by our loan experts, who will then reach out to you for a detailed consultation. Our representatives will help you choose a loan program that aligns with your financial goals and will work on tailoring the contract for you.

Once the consultation is complete, we’ll quickly process the loan so that you have access to the funds you need without any delays.

The interest rate for your private money loans is calculated based on several factors after our comprehensive evaluation process. From your payment history to your credit score and other factors, there are several considerations.

What’s important to keep in mind,though is that there are no fixed interest rates, and we evaluate each application individually to make sure the terms are fair and tailored for your financial profile. Moreover, the entire process is transparent, and the interest rates we come up with are competitive, ensuring you can reach your financial goals without any hurdles.

No, you won’t incur any prepayment penalties when settling your hard money loan with Insula Capital Group ahead of the deadline. We prioritize flexibility and transparency in our lending practices, aiming to provide borrowers with the freedom to manage their finances effectively.

Our commitment to fair and borrower-friendly terms means you can pay off your loan early without worrying about additional charges. At Insula, we value your financial success and offer a hassle-free experience with no hidden fees for responsible and prompt loan repayments.

Top Hard Money Lenders Loan Cities in Arizona

Get Your Hard Money Loan Approved in 24 Hours

Insula Capital Group is dedicated to providing reliable and transparent lending services. Investors across Arizona can benefit from our quick approval times and flexible loan terms any time they want. Our experts underwrite specialized loan contracts in-house, enabling them to address your specific needs within 24 hours. Feel free to go through our just-funded projects to learn more!

You can contact our private money lenders to get started.