Private Money Lenders | Hard Money Loans in Illinois

If you’re looking to take your investment game to the next level in Illinois, our hard money loans are the key to unlocking your success. We work diligently to help you dive into the real estate market without any financial hassle.

Our team works round the clock to provide customized loan terms for our clients. We’ve got financial experts who can analyze your financial condition and prepare a personalized hard money financing plan without any delay.

Learn more about our hard money financing options in Illinois.

Enhance Your Real Estate Investments With Our Hard Money Loans In Illinois

With over thirty years of experience in the industry, we know the ins and outs of real estate financing.We can help you bid farewell to lengthy bank approvals and embrace our streamlined loan process for maximum efficiency. With our quick and flexible financing options, you’ll have the power to close deals faster, expand your portfolio, and maximize your profits.

Our loan features, like no pre-payment penalties, fast approvals, no junk fees, low interest rates, and minimal documentation, can help propel your real estate investment growth.

Get in touch with us for more information about our loan deals.

Successfully Complete Real Estate Projects With Hard Money Loans

Hard money loans can be a beneficial financing option for real estate projects as they offer unique benefits that cater to specific needs in the industry. Unlike traditional loans, hard money loans are offered by private lenders who offer loan approvals within days or weeks.

The biggest advantage of using hard money loans is the speed of approval. Conventional loan processes have extensive paperwork, lengthy credit checks, and never-ending approval periods, which can make the process time-consuming and hectic. Fortunately, hard money lenders focus on the value of the collateral to give loan approvals quickly and offer faster access to capital.

Hard money loans offer flexibility that you may not get with conventional financing. Traditional lenders may have strict criteria, which can make it challenging for investors with low credit scores to get the capital they need. You can negotiate your lending terms with a private lender for a hard money loan and get approval even with an imperfect credit history. Hard money loans can also be an excellent option for short-term financing needs. You can use these loans to acquire, renovate, or flip properties quickly. Top of Form

If you want to learn more about how hard money loans can help you finance real estate projects, our team is here to guide you. Our experts will examine the complexities of your project and provide effective financing solutions. Our team works closely with every client to offer asset-based financing according to their requirements.

The Booming Real Estate Market In Illinois

Finding it difficult to make successful real estate investments in Illinois? If yes, we can help you. We understand the significance of conducting thorough market research before purchasing any property. Have a look at some exciting statistics that’ll assist you in making an informed decision:

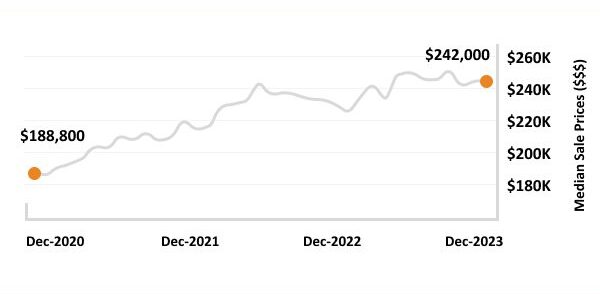

- Median Home Value: $243,355

- 1-Year Appreciation Rate: +13.6%

- Median Sales Price: $249,000

- Median Rent Price: $1,141

- Price-To-Rent Ratio: 77

- Unemployment Rate: 8%

- Population: 12,671,821

- Median Household Income: $65,886

The Real Estate Landscape In Arkansas

12,671,821

Population

$65,886

Median Household Income

$243,355

Median Home Value

+13.6%

1-Year Appreciation Rate

17.77

Price-To-Rent Ratio

$1,141

Median Rent Price

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Find Out More About The Thriving Real Estate Market In Illinois

With a growing economy, strong job market, and attractive urban areas, Illinois provides a lucrative investment opportunity for individuals looking to earn hefty profits. The economic diversity in Illinois helps create a stable real estate market. As an investor, you can find opportunities in residential and commercial real estate and kickstart your projects in no time.

The job market in Illinois is constantly growing, which is increasing demand for real estate. Cities like Chicago are major business hubs and create a favorable environment for real estate investment. The mix of urban and suburban areas in Illinois provides a wide range of investment options.

However, purchasing a property in Illinois without any financial backup can be tricky. If you need extensive financial assistance for your real estate venture, our team can help you. We’ll examine your real estate plan and provide a hard money financing solution accordingly.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

You can apply for a private hard money loan from the comfort of your home by using our online full application form.

As a private money lender in Illinois, we examine various factors to provide loan approval, like your credit history, real estate experience, and project feasibility. Visit our just-funded project section to learn more about our hard money loan deals.

Yes, you can get loan approval without a high credit score. In a bid to provide financial access to a wide range of clients, we cater to clients with average credit scores.

Top Hard Money Lenders Loan Cities in Illinois

Connect With Us!

At Insula Capital Group, we know conventional lending options can be time-consuming and restrictive, affecting your ability to earn significant profits in the real estate market. This is why we offer flexible real estate financing options for homeowners, investors, and property developers.

Here’s a list of our loan programs:

Fix and flip loans

Residential rental programs

Multifamily mixed-use loans

New construction loans

Ready to use our hard money loan options? Contact our team today!