Private Money Lenders | Hard Money Loans in Missouri

Missouri offers a unique blend of historic and cultural attractions, natural beauty, and friendly communities, making it an excellent place to call home. Besides the low cost of living, real estate is also a worthwhile investment in Missouri.

The consistently growing real estate market has propelled many to invest in the region. Some envision commercial enterprises, while others prefer luxury condos for residential use. No matter what type of project you want to invest in, our dedicated professionals are here to ensure the successful fruition of your project in the dynamic Show-Me state.

Here’s How The Team At Insula Capital Group Can Help You!

Our financial programs have helped bring to life diverse projects, some of which you can explore in our just-funded projects. We offer new construction loans, fix & flip financing, multifamily mixed-use loans, and residential rental loans with flexible terms, minimal documentation, and competitive rates. You can also request personalized customer support, even though with our seamless online application system integration, you’ve got nothing to worry about!

Get in touch to discuss the best financing solution for your project with professional private money lenders in Missouri.

Why Should You Opt For Hard Money Loans In Missouri?

Whether you want to kickstart a fix & flip project or a construction venture, financing will be necessary if you want to complete your projects without any hassle.

In such circumstances, you might think about opting for loans from conventional banks. However, these traditional institutions have stringent loan requirements and a lengthy application process, which makes it an ineffective option for investors looking for quick financing with excellent repayment terms.

This is why we recommend using hard money financing services for your real estate projects in Missouri. At Insula Capital Group, our private lending team can quickly analyze the collateral and provide you with a hard money loan deal accordingly.

Unlike conventional banks, we don’t scrutinize your credit scores or financial histories to offer loan approval. This makes it easier for financially struggling individuals to get the capital they need for real estate ventures.

From residential to commercial properties, you can use hard money loans to finance a wide range of projects. You can also use these loans to fix properties and sell them for a higher price to earn hefty profits.

If you want a flexible hard money loan deal for any upcoming project in Missouri, consider connecting with our team.

Learn All About The Real Estate Market In Missouri

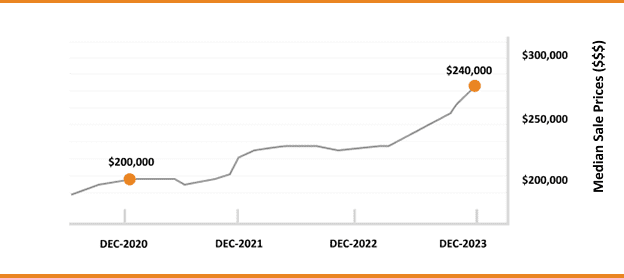

If you want to make an informed decision about investing in Missouri’s real estate market, you must focus on completing thorough market research. From analyzing sale prices to home values, you must examine various factors to make a strategic plan. Here are some statistics that’ll help you make an investment strategy:

- Median Home Value:$225,067

- 1-Year Appreciation Rate:+16.2%

- Median Days On Market:28

- Median Selling Price:$238,500

- Median Rent Price:$976

- Price-To-Rent Ratio:77

- Unemployment Rate:6%

- Population:6,168,187

- Median Household Income:$57,290

- Foreclosure Rate: One in every 4,967 homes

The Real Estate Landscape In Missouri

6,168,187

Population

$976

Median Rent Price

$225,067

Median Home Value

+26.2%

1-Year Appreciation Rate

$57,290

Median Household Income

21.77

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Invest In Missouri’s Real Estate Market For Higher Returns

With an emerging economy and numerous investment opportunities, trading properties in Missouri is an exceptional option. Missouri offers an excellent real estate environment for investors who need high returns quickly.

The affordable housing market makes Missouri an attractive destination for families and investors from all over the US. Whether you want to fix & flip properties or long-term rentals, the team at Insula Capital Group can help you invest.

Ready to apply for a Hard Money Loans?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Check out our comprehensive loan programs and pick out the one that works best with your financial situation, project type, and scope. Once you know which hard money loan you’re applying for, fill out the application forms, attach relevant documents, and submit it all online. Our team will get back to you promptly after reviewing your application.

You can secure a hard money loan through Insula Capital Group even if you have bad credit. As private money lenders, we’re more focused on your property’s value and exit strategy rather than your credit scores. If you’d like to learn more about our eligibility criteria, you can speak to one of our team members for further details.

Private money lenders like Insula Capital Group can finance various properties, including residential, commercial, and industrial properties. We have a wide range of loan programs that can be tailored to your requirements, including new construction loans, fix & flip financing, multifamily mixed-use loans, and residential rental loans.

Top Hard Money Lenders Loan Cities in Missouri

Seize The Best Real Estate Opportunities in Missouri with Top-Rated Private Money Lenders

No matter where and how far your investment journey takes you, Insula Capital Group is there to support you every step of the way. We aim to build long-term relationships with our clients, and that starts with offering financing that supports your success.

We prioritize customer satisfaction and aim to provide a seamless borrowing experience. Our dedicated team of professionals is available round-the-clock! Contact us now so they can answer your questions, guide you through the lending process, and meet your needs.