Private Money Lenders | Hard Money Loans in New Mexico

New Mexico is known for its rich cultural heritage, vibrant communities, and landscapes. However, as with any state, there are times when individuals and businesses may find themselves in need of financial assistance. During these challenging times, it is important to have access to reliable and efficient financial solutions. That’s where Insula Capital Group comes in.

Insula Capital Group is a reputable hard money lender in New Mexico, offering flexible and accessible lending options to individuals and businesses alike. Our private money lenders understand the unique challenges borrowers face and strive to provide personalized solutions to meet their specific needs.

Check out our loan programs and just-funded projects for more information.

Get in Touch

Unmatched Hard Money Funding in New Mexico

Our hard money lenders help aspiring investors, homeowners, and developers who want to finance their projects in New Mexico. Whether you are looking to purchase a fixer-upper property, invest in real estate, or start a new business venture, Insula Capital Group can provide the financial support you need.

With our unmatched hard-money funding in New Mexico, we can make your financial goals a reality. Our hard money loans are personalized to meet your unique needs and offer flexible terms to ensure a smooth and successful borrowing experience.

We offer fix and flip loans, residential rentals, multifamily mixed-use, and new construction loans. Discuss your project details with our hard money lenders, and they will work closely with you to provide a tailored lending solution that meets your requirements.

The Benefits of Hard Money Loans

At Insula Capital Group, we understand the unique challenges and opportunities within the real estate market. That’s why we offer hard money loans, a strategic financial tool designed for the dynamic investor. These loans are characterized by their swift funding process, allowing for the bypassing of traditional banking delays. Our focus is on the value of the real estate asset, enabling us to provide flexible terms that accommodate a wide range of investors, even those navigating credit challenges.

Our hard money loans are specifically crafted to support investors through every phase of their project—from acquisition and renovation to the final sale. This approach accelerates project timelines and maximizes profitability in competitive markets. With Insula Capital Group, investors gain a partner committed to enhancing the efficiency and success of their real estate ventures.

Our streamlined application and rapid approval process reflect our dedication to being a pivotal financial partner in your investment journey. Let us empower you to move swiftly in the market, seize opportunities, and achieve your real estate investment goals. At Insula Capital Group, your success is our priority.

Insightful Statistics: New Mexico’s Real Estate Market in 2024

New Mexico’s real estate market in 2024 is shaping up with distinct features that make it attractive for both buyers and sellers, supported by the state’s diverse economy and unique living conditions.

Here’s a detailed look at the key statistics and forecasts that define the housing landscape in New Mexico:

- Average Home Prices: The median home price in New Mexico remains steady at $ 288,227, with predictions of a marginal increase due to the tight inventory across the state.

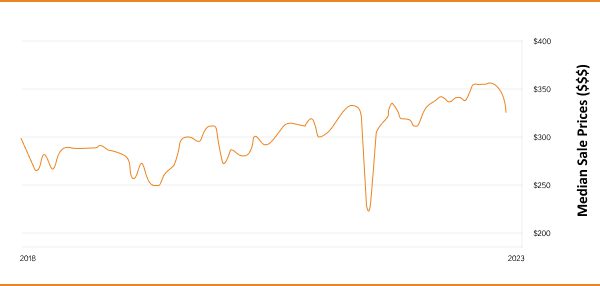

- Median Sale Price:$349,200

- 1-YearAppreciation Rate:+3.9%

- Median Days On Market:39

- Median Days To Pending:7

- Homes For Sale:3,457

- Homes Sold Above List Price:3%

- New Listings:1,171

- Months Of Supply:3

- Foreclosure Rate:One in every 6,510 homes

- Population:2,113,344

- Median Household Income:$54,020

- Unemployment Rate:5%

- Sales Dynamics:There’s been a significant decrease in home sales by 24.6% year-over-year as of September 2023, highlighting a challenging market for buyers.

- Inventory and Supply:With only 3,000 homes listed for sale, New Mexico is experiencing a scarcity that intensifies the seller’s market conditions. The months of supply stand at 3 months, underscoring the demand surpassing the available supply.

- Rental Market Variability:Rental prices show statewide diversity, with Santa Fe averaging $1,790 and White Rock at $1,589, indicating varied investment opportunities in the rental sector.

*All New Mexico housing market statistics are as of the third quarter of 2023.

2024 Housing Market Predictions for New Mexico:

The outlook for New Mexico’s housing market includes several key predictions:

- Return of Home Sellers:2024 is expected to see sellers who previously hesitated, re-entering the market, potentially easing the tight inventory situation.

- Stabilization of Mortgage Rates:After peaking at 7.79% in October 2023, mortgage rates are anticipated to stabilize in the latter half of 2024, making financing more accessible for buyers.

- Increase in Buyer Activity:Lowering interest rates and easing inflation are predicted to rejuvenate buyer interest in the housing market.

- Continued Price Growth:Despite the market challenges, home prices in New Mexico are expected to keep rising due to the ongoing low supply and high demand dynamic.

- Boost in New Home Construction Sales:An increase in new home sales is anticipated, with builders likely offering incentives to attract buyers.

Market Characterization for 2024:

With predictions of increased listings and buyer activity, 2024 can balance out to offer opportunities for both buyers and sellers. Despite the challenges faced in 2023, easing mortgage rates and sellers’ return to the market could stimulate a more active and balanced real estate environment in New Mexico.

Alabama’s Real Estate Market

2,113,344

Population

$349,200

Median Sale Price

288,227

Average Home Price

+3.9%

1-Year Appreciation Rate

One in every 6,510 homes

Home Foreclosure Rate

3,457

Homes For Sale:

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in New Mexico’s Real Estate Market?

New Mexico’s real estate market presents a compelling blend of unique characteristics and opportunities, making it an increasingly attractive option for investors and homebuyers alike. Known as the Land of Enchantment, New Mexico offers a mix of affordability, cultural richness, and economic opportunities that contribute to its growing appeal in the real estate sector.

Affordability and Growth Potential

New Mexico stands out for its affordability in the housing market, offering significant value compared to neighboring states. This affordability, coupled with a steady appreciation of home values, presents a ripe opportunity for investment and home ownership.

Economic and Cultural Diversity

The state’s economy is bolstered by energy, tourism, and film production sectors, contributing to a diverse job market. New Mexico’s rich cultural heritage and vibrant arts scene, particularly in cities like Santa Fe and Albuquerque, add to its desirability, attracting a variety of residents and investors.

Strategic Location and Investment Incentives

New Mexico’s strategic position, bordering Mexico and its proximity to larger markets like Texas and California, enhances its appeal for business and real estate investment. The state offers various incentives, including tax credits and exemptions, which further enhance the attractiveness of its real estate market.

Quality of Life and Natural Beauty

The state is renowned for its stunning natural scenery, from desert landscapes to mountain vistas, offering outdoor recreation opportunities year-round. This natural beauty, combined with a lower cost of living, contributes to a quality of life that draws more people to New Mexico.

Emerging Markets and Development Opportunities

With cities like Albuquerque experiencing growth in the tech sector and Santa Fe being a hub for arts and culture, New Mexico showcases neighborhoods and markets with high potential for development and investment. The state’s focus on sustainable living and green energy also opens up new avenues for eco-friendly real estate projects.

Investing in New Mexico’s real estate means engaging with a market that offers financial opportunities and a lifestyle enriched by natural beauty, cultural diversity, and economic resilience. This combination makes New Mexico an enticing region for real estate investment, promising both short-term gains and long-term growth.

Ready to apply for a Hard Money loan?

FAQs: Your Investment Journey Simplified

At Insula Capital Group, we understand the importance of transparency and affordability when it comes to interest rates. That’s why we offer competitive rates determined based on each loan’s specifics.

The application process at Insula Capital Group is straightforward and hassle-free. Simply fill out our online application form with your project details, and one of our hard money lenders will review it promptly.

Insula Capital Group extends hard money loans across various property types, including residential, commercial, and land development projects. Our lending solutions are versatile, accommodating various real estate investment strategies, from renovations and flips to new constructions.

Top Hard Money Lenders Loan Cities in New Mexico

Contact Us Now!

When it comes to accessing reliable and efficient financial solutions, Insula Capital Group is the answer. Contact our private money lenders or fill out our online application form today to get started on your hard money loan in New Mexico.

Don’t wait any longer and miss out on the unmatched hard money funding that Insula Capital Group can offer.