Private Money Lenders | Hard Money Loans in Tennessee

At Insula Capital Group, we are committed to materializing your real estate dreams in Tennessee. As your premier hard money lender, we deliver an array of comprehensive financing solutions, providing unrivaled support to investors across Chattanooga, Clarksville, Knoxville, Memphis, Nashville, and beyond, turning their real estate aspirations into tangible successes.

Partner with Tennessee’s Premier Hard Money Lenders at Insula Capital Group

Tennessee’s real estate market is as distinct as its rich history and culture. Navigating this unique landscape requires tailored strategies and financing plans, and that’s where we come in. We have developed specialized loan programs to ensure you have the right tools to seize every opportunity:

1. Revitalize and Reap Rewards with Our Fix and Flip Loans

Insula Capital Group’s fix and flip loans in Tennessee are your keys to transforming properties brimming with untapped potential into veritable gems. Enrich Tennessee communities while you build your portfolio and drive your investment success. An exciting opportunity awaits you!

2. Forge Ahead with New Construction Loans

Is your goal to contribute to Tennessee’s skyline? Our new construction loans in Tennessee provide the necessary capital for you to bring your vision to life, guiding your project from its groundbreaking initiation to its successful completion.

3. Harness the Power of the Market with Residential Rental Loans

Tennessee’s robust rental market is an investor’s dream. Our residential rental loans empower you to carve out a sustainable income stream from rental properties, enriching your portfolio for the long term. Dive into the details and unlock your portfolio’s potential today.

4. Navigate with Ease using the Multifamily Bridge Loan Program

In Tennessee’s fast-paced multifamily property market, you need a partner that keeps you ahead of the curve. Our multifamily bridge loan program offers the financial agility to manage transitional financing periods effectively.

Ready to take the leap? Connect with our team of experts, who can help align our financing solutions with your investment goals.

The Strategic Benefits of Hard Money Loans

Hard money loans are a strategic boon for real estate investors navigating fast-moving markets. Renowned for their swift processing, these loans significantly reduce the wait time typically associated with traditional financing methods.

Structured to reflect the value of the real estate asset, they offer flexibility and are accessible even to investors with varied credit histories. This adaptability makes these loans particularly beneficial for swiftly moving through the stages of property acquisition, renovation, and sale.

Insula Capital Group’s streamlined application and rapid approval process are testaments to their commitment to supporting investors’ success, further cementing their role as a key player in real estate investment. With these loans, investors can efficiently capitalize on market opportunities and enhance their project profitability.

Insightful Statistics: Tennessee’s Real Estate

Tennessee’s real estate market in 2024 showcases a dynamic and growing landscape, offering a variety of opportunities for both buyers and sellers.

The market is characterized by a mix of rising home prices and a competitive environment, with new constructions also expected to play a significant role.

Here’s a summary of the key statistics and predictions for the Tennessee real estate market:

- Average Home Price: $311,628

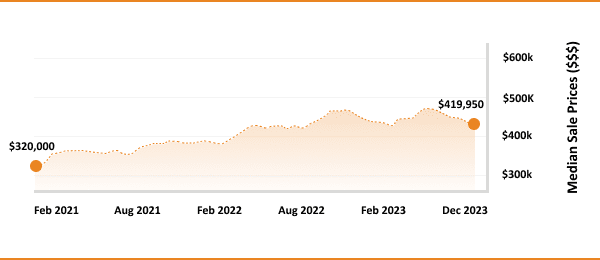

- Median Sale Price: $384,900

- 1-Year Appreciation Rate: +2.5%

- Median Days On Market: 46

- Median Days To Pending: 11

- Homes For Sale: 31,013

- Homes Sold Above List Price:4%

- New Listings: 9,717

- Months Of Supply: 3

- Foreclosure Rate: One in every 6,736 households

- Population: 7,051,339

- Median Household Income: $58,516

- Unemployment Rate: 3%

Tennessee’s House Flipping Statistics

255,7,051,339

Population

$384,900

Median Sale Price

$7,051,339

Average Home Price

+2.5%

1-Year Appreciation Rate

1/6,736

Home Foreclosure Rate

31,013

Homes For Sale

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in Tennessee’s Real Estate Market?

Investing in Tennessee’s real estate market is an opportunity brimming with potential, marked by its economic resilience and cultural vibrancy. The state’s economy is solid and growing, supported by industries like healthcare, manufacturing, and tourism, which attract a diverse workforce. This economic strength, coupled with Tennessee’s engaging culture and recreational opportunities, draws an increasing number of new residents.

The housing market in Tennessee has seen a consistent rise in home values, indicating a flourishing market. As of late 2023, the median home price was around $367,900, showing a year-over-year growth. Such growth is a positive sign for investors looking for appreciating assets. Despite this price rise, the market in Tennessee is expected to remain stable and grow further in 2024, with no signs of a downturn on the horizon.

Cities like Nashville and Memphis stand out as hubs for real estate investment. With its thriving music scene and booming job market, Nashville offers various investment options, from residential properties to commercial spaces. Memphis, known for its rich history and cultural significance, also presents numerous opportunities, especially in the residential sector. These cities, among others in Tennessee, are witnessing significant development, making them prime spots for long-term investment.

Investors in Tennessee’s real estate market can anticipate immediate returns and long-term growth, given the state’s robust economy, affordable cost of living, and appealing lifestyle. This mix of economic strength, cultural richness, and a steady flow of new residents creates a fertile environment for real estate investment, offering lucrative prospects for both experienced investors and those new to the market.

Ready to apply for a Hard Money loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

We stand out through a unique blend of flexibility, swift approval, tailored loan programs, and ongoing support, empowering investors with the financial tools they need to succeed in Tennessee’s dynamic real estate market.

Speed is key in our services. After receiving all necessary documentation and appraisal, we typically close loans within 5-10 business days.

We proudly cater to investors across Tennessee, from Chattanooga to Nashville, providing customized hard money loan solutions to suit varied real estate investment needs.

Top Hard Money Lenders Loan Cities in Tennessee

Partner with Tennessee’s Top Hard Money Lenders!

Aligning with Insula Capital Group signifies more than finding a private money lender; it’s about forging a partnership with a team that gets your vision and provides the financial tools to turn that vision into reality. Have a look at our recently funded projects to witness our unwavering commitment to helping investors succeed.

We invite you to start your journey with us today by filling out our easy-to-use prequalification form. Ready for a deeper dive? Get into the nitty-gritty with our comprehensive full loan application. Eager to learn more about what we offer? Contact us to schedule a consultation.

Let’s chart the course of your Tennessee real estate success story with Insula Capital Group today. Because at Insula Capital Group, we don’t just fund loans; we fuel dreams.