Private Money Lenders | Hard Money Loans in Wisconsin

Get in Touch

Unlock Real Estate Success in Wisconsin with Insula Capital Group

Insula Capital Group is your go-to private money lender in Wisconsin, committed to fueling your real estate success across Madison, Milwaukee, Green Bay, Racine, and Kenosha. We specialize in hard money loans tailored to help you navigate and leverage the opportunities within Wisconsin’s unique real estate landscape.

Reinventing Real Estate Investments with Our Hard Money Loan Programs

Wisconsin offers countless real estate opportunities, each presenting its unique rewards and challenges. To ensure you thrive in this dynamic market, Insula Capital Group provides various specialized hard money loan programs:

Creating Value with Our Fix and Flip Loans

With our fix and flip loans in Wisconsin, you can unlock and enhance the hidden potential in distressed properties. Boost your profits while transforming Wisconsin’s neighborhoods, one property at a time.

Shaping Skylines with New Construction Loans

Our new construction loans provide the capital you need to translate architectural dreams into reality. Contribute to Wisconsin’s evolving cityscapes, secure in the robust financial backing of Insula Capital Group.

Establishing Long-Term Wealth with Residential Rental Loans

Our residential loan program is your pathway into Wisconsin’s bustling rental market. Diversify your portfolio and create sustainable income streams by investing in lucrative rental properties.

Seizing Opportunities with the Multifamily Bridge Loan Program

The multifamily property market in Wisconsin moves fast. Keep pace with our agile multifamily bridge loan program, which offers swift, flexible financing during transitional periods.

Got queries? We’re here to assist! With Insula Capital Group, you’re never alone in your real estate journey. Our dedicated team of seasoned professionals is always ready to guide and support you.

Maximize Your Real Estate Investments with Hard Money Loans in Wisconsin

Hard money loans present an efficient financial strategy for real estate investors targeting the dynamic Wisconsin market. These loans stand out for their rapid processing, allowing investors to bypass the extended timelines often associated with traditional financing.

Insula Capital Group offers hard money loans based on the property’s worth, providing flexible conditions that cater to a wide range of investment strategies, even for those with credit challenges. This flexibility empowers investors to swiftly move through the stages of purchasing, renovating, and selling properties, thus maximizing their returns in Wisconsin’s competitive real estate sectors.

With a streamlined application and swift approval process, Insula Capital Group reinforces its role as a fundamental partner for the success of various real estate ventures, proving indispensable for achieving your investment goals.

Wisconsin’s Real Estate Market: A Comprehensive Overview for Hard Money Lending

Wisconsin’s real estate market in 2024 continues to demonstrate resilience and growth, offering a robust platform for investors and hard money lenders. The state’s housing sector is characterized by a tight inventory and a seller’s market, driven by a high demand that outstrips the available supply.

This scenario has led to competitive pricing, benefiting sellers and challenging first-time homebuyers due to the limited inventory. Despite these conditions, Wisconsin remains a promising market for real estate investment, thanks to its economic stability and diverse job market.

Key Statistics for Wisconsin’s Housing Market:

- Population: 5,892,539

- Median Household Income: $67,080

- Unemployment Rate: 4%

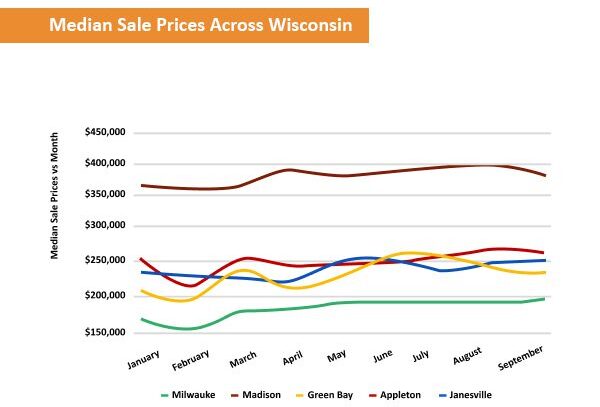

- Average Median Home Price: As of the latest data, it stands at $297,200, marking an 8.4% increase from the previous year, highlighting a continuing appreciation in property values.

- Home Sales Dynamics: There has been a decrease in the number of home sales by 16.6% in September 2023 compared to the same month in 2022, reflecting a competitive market environment.

- Inventory Trends: The inventory of available homes for sale has decreased by 10% from the previous year, with only a 2-month supply, indicating a market that heavily favors sellers.

- Rental Market Insights: Rent prices show variation across the state, with Milwaukee averaging $1,410 and Appleton around $1,200, presenting different investment opportunities in the rental segment.

Wisconsin’s housing market’s stability, bolstered by a strong economy, a vibrant job market, and reasonable living costs, presents a favorable landscape for hard money lending and real estate investment. Investors considering the Wisconsin market should be prepared for a competitive environment, with strategic planning and local market knowledge being key to success.

*All Wisconsin housing market statistics are as of the second quarter of 2023.

Wisconsin’s Real Estate Market

5,892,539

Population

$285,300

Median Sale Price

$297,200

Average Median Home

16.6%

Home Sales Dynamics

$67,080

Median Household Income

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in Wisconsin’s Real Estate Market?

Wisconsin’s real estate market stands out as a prime investment opportunity, fueled by its diverse economic landscape, quality of living, and strategic positioning. This state, known for its manufacturing, agriculture, and education sectors, creates a stable foundation for growth and investment in the property sector.

Economic Diversity Fuels Real Estate Demand

Wisconsin’s economy blends traditional industries and modern innovation, from dairy farming and manufacturing to healthcare and information technology. This diversity sustains job growth and drives demand for residential and commercial properties across the state.

Quality of Life and Educational Excellence

The state’s focus on maintaining high-quality education systems and infrastructure investment makes it attractive for families and professionals. Cities like Madison are recognized for their world-class universities, contributing to a skilled workforce and vibrant cultural scene. Meanwhile, the state’s commitment to preserving its natural beauty, with an abundance of parks and lakes, enhances the living experience, drawing in those seeking a balance between urban and outdoor lifestyles.

Urban Growth and Historic Charm

Wisconsin offers a unique mix of urban development and historic charm. With its thriving arts scene and revitalization projects, Milwaukee showcases the potential for urban investments. At the same time, smaller communities like Eau Claire and La Crosse highlight the appeal of investing in areas with rich historical backgrounds and growing economies.

Strategic Market Position

Situated in the heart of the Midwest, Wisconsin’s location is strategic for businesses looking to access both the northern and central United States markets. Its transportation networks, including major highways, ports on the Great Lakes, and a growing logistics sector, make it a pivotal area for commercial real estate development.

A Market on the Rise

The Wisconsin real estate market benefits from a balanced approach to growth, maintaining affordability while experiencing steady appreciation. This makes it an appealing market for investors looking for both short-term gains through flips and renovations and long-term investments through rental properties.

Investing in Wisconsin’s real estate market means tapping into a region with a robust economic foundation, high quality of life, and significant growth potential. The state’s blend of urban development, educational excellence, and strategic location positions it as a compelling choice for real estate investors aiming to diversify their portfolios and capitalize on emerging market trends.

Ready to apply for a Hard Money loan?

Frequently Asked Questions

We are more than a lender. As an investment partner, we provide a comprehensive suite of hard money loans tailored to Wisconsin’s real estate market. Coupled with our fast approvals and investor-centric services, we make your journey seamless and successful.

Our loans are intended for non-owner-occupied properties meant for investment. Eligible properties include single-family homes, multifamily residences, commercial properties, and land for new construction.

We’ve simplified our process to expedite your access to funds. It starts with you filling out our prequalification form, after which our team evaluates your proposal and assists with the subsequent loan approval and funding process.

Top Hard Money Lenders Loan Cities in Wisconsin

Embrace Real Estate Success in Wisconsin with Insula Capital Group

When you choose Insula Capital Group, you’re choosing a team that’s as invested in your success as you are. We pride ourselves on our commitment to our client’s real estate ambitions, which is visible in our vast array of recently funded projects.

Excited about the potential that lies ahead in Wisconsin’s real estate market? We share your excitement! And we’re ready to take the next step with you. If you have any questions or need further assistance, don’t hesitate to contact us or schedule a consultation. Ready to make your mark in Wisconsin’s real estate market? Submit your full loan application today. Let’s work together to write your Wisconsin real estate success story with Insula Capital Group!