Multifamily Bridge Loans in Pennsylvania

Whether you are purchasing, renovating, or repositioning a multifamily asset, securing the right financing can make or break your project. At Insula Capital Group, we offer multifamily bridge loans in Pennsylvania, a financial solution designed for short-term needs that pave the way for long-term success.

Multifamily bridge loans are short-term financing solutions designed to provide real estate investors with immediate capital to bridge the gap between acquiring a property and securing long-term financing. On the other hand, multifamily properties are residential buildings with more than four units, including apartment complexes, duplexes, and condominiums. Investing in such properties can be highly profitable, but the upfront costs can be substantial, especially if the property requires significant upgrades or rehabilitation.

Multifamily bridge financing in Pennsylvania by Insula Capital Group enables investors to purchase and improve these properties, ensuring they can be leased out at higher rates or sold for a profit once the work is completed.

Get in Touch

How Multifamily Property Bridge Loans in Pennsylvania Work

Multifamily bridge loans typically cover 70% to 85% of the property’s purchase price or after-repair value (ARV), depending on the specific deal. These loans are usually interest-only, meaning that during the term of the loan, the borrower only pays interest on the loan amount, with the principal balance due at the end of the loan period.

At Insula Capital Group, we assess each loan application based on the property’s potential value rather than solely focusing on its current state. This allows us to extend financing to properties that need significant improvements, giving investors the freedom to enhance their value through renovations, repositioning, or increased occupancy.

Our multifamily bridge loan lenders in Pennsylvania will work closely with you to evaluate your investment’s needs, ensuring you receive a loan package with the most favorable terms. Typical loan features are discussed below.

- Loan amounts ranging from $500,000 to $10 million

- Terms from 6 months to 3 years

- Interest rates based on risk assessment, typically higher than traditional loans but compensating for the short-term nature and speed of the loan

- Interest-only payments throughout the loan term, with a balloon payment at the end

When your project is completed and the property has stabilized, you can either refinance into a permanent loan or sell the asset for a profit. Connect with our Multifamily bridge loan lenders for more information.

Understanding Multifamily Bridge Financing Use Cases in Pennsylvania

Multifamily bridge loans in Pennsylvania, by Insula Capital Group, can be used in a variety of real estate scenarios. Some common uses for these loans are discussed below.

1. Property Acquisition

For investors looking to purchase multifamily properties quickly, multifamily bridge loans in Pennsylvania provide the capital to close deals before long-term financing is secured.

2. Renovations and Repositioning

Properties that require significant updates to become fully operational often do not qualify for traditional loans. A bridge loan enables investors to finance these improvements and then refinance once the property’s value has increased.

3. Cash-Out Refinancing

Investors may also use bridge loans to extract equity from a property, giving them the capital they need for other investments or property improvements.

4. Stabilization Financing

If a multifamily property needs to achieve a certain occupancy level or generate higher rental income before it qualifies for permanent financing, a multifamily bridge loan can provide interim financing until those criteria are met.

5. Value-Add Opportunities

Many investors seek to enhance the value of underperforming properties by making strategic renovations or management improvements. Bridge loans help fund these projects, allowing investors to increase rents, occupancy, and overall property value.

Contact our team for any questions about multifamily property bridge loans in Pennsylvania.

Insights into Multifamily Bridge Loans in Pennsylvania

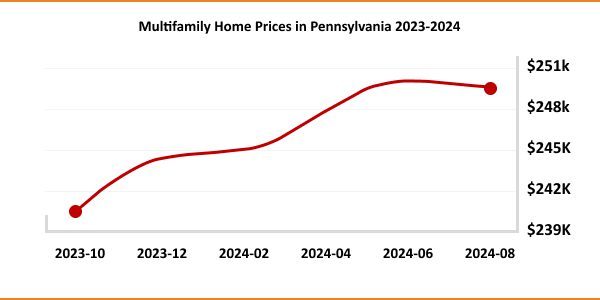

Opting for multifamily bridge financing in Pennsylvania? Here are some statistics to learn before.

- Average Multifamily Property Price in Pennsylvania: $2,574,540

- Median Rent for Multifamily Units: $1,550. 3

- Estimated Annual Return on Investment (ROI): 8%

- Average Multifamily Bridge Loan Interest Rate: 10.97%

Key Statistics for Multifamily Bridge Loans in Pennsylvania

$2,574,540

Median Multifamily Property Price

$1,550. 3

Median Rent Price

8%

Median ROI on Multifamily Properties

20.3

Price-To-Rent Ratio

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Choose Insula Capital Group for Multifamily Bridge Financing in Pennsylvania?

At Insula Capital Group, our multifamily bridge loan lenders in Pennsylvania are experts in the state’s real estate market and understand the challenges and opportunities you face. We offer the following.

1. Fast Approvals

We understand that time is valuable in real estate. Our experienced team works quickly to approve and fund multifamily bridge loans, ensuring that you have the capital you need when you need it.

2. Tailored Loan Structures

Insula Capital Group offers customized loan solutions that align with your investment strategy. Our team will work with you to structure a loan that fits your timeline and budget.

3. Expert Guidance

Navigating real estate financing can be challenging, especially in a market as competitive as New York. Our team of financial experts provides personalized guidance, helping you make informed decisions and maximize your investment returns.

4. Competitive Rates

While multifamily bridge loans in New York typically have higher interest rates than traditional loans, Insula Capital Group strives to offer competitive rates that reflect the unique needs of our clients. We’re committed to providing fair, transparent loan terms that help you achieve your financial objectives.

Ready to apply for a multi-family bridge loan?

Frequently Asked Questions

Fill out our online application form to get started on multifamily bridge financing in Pennsylvania.

We provide hard money financing for the following services:

Get in Touch with Us for Multifamily Bridge Property Loans in Pennsylvania

At Insula Capital Group, we provide fast, flexible financing solutions to help real estate investors succeed. If you’re interested in learning more about our multifamily bridge loans in Pennsylvania, or if you have any questions about how our lending services can support your investment goals, we’re here to assist.

Our multifamily bridge loan lenders in Pennsylvania are ready to offer personalized advice and loan packages. Whether you’re looking to acquire, renovate, or reposition a multifamily property, we can provide the capital and guidance necessary to move your project forward.

Reach out to us or check our website to learn more information about our real estate financing across the US.