New Construction Loans in Florida

Building a property in Florida is a bold choice.

It’s no secret that the state has some of the most competitive housing prices in the US. Florida’s real estate market can be challenging to navigate, especially without any financial support. And developing a property instead of buying one can be even tougher. Luckily, you can always apply for a new construction loan!

Read more about how new construction loans in Florida can help you bring your ideal property to life.

Achieve Financial Freedom with a New Construction Loan in Florida

There are multiple complicated stages involved in any construction project. When building a property from scratch, you should have enough funds to finance every aspect of it.

Buying land is often the first step. Unless you have been saving for many years, you will likely struggle to put down a hefty investment in a property right away. However, this is no longer a problem with a new construction loan. Private money lenders like Insula Capital Group will allow you to withdraw funds for each stage of your project as it starts, including land acquisition! Get in touch with us for more details about our new construction loans in Florida.

Go through our FAQs to learn more about our new construction loans in Florida.

How to Get a New Construction Loan from Insula Capital Group

The team of loan advisors and underwriters at Insula Capital Group has been in this business for over three decades. We have the expertise required to handle your unique financing case.

Whether you want to use the funds to hire skilled contractors or acquire quality materials, our new construction loan can be handy. During our consultation, we will review all the important aspects of the loan-securing process with you. This will help us create a specialized contract for you.

Ready to apply for a New Construction loan?

Get in touch with our experienced team for more details about our financing services.

Key Statistics and Forecasts for Florida’s Housing Market

Florida’s housing market is shaping up to be a dynamic environment, marked by positive trends and a promising outlook for both buyers and sellers. The state’s robust real estate landscape is influenced by its diverse economy, attractive lifestyle, and the appeal of its cities and towns.

Critical Statistics to Consider:

- Median Sales Price: The median sales price for single-family existing homes in Florida reached $413,000, a 3.3% increase from the previous year. For condo-townhouse units, the median price was $330,000, marking a 7.5% increase year-over-year.

- Inventory Expansion: The inventory for single-family homes and condo-townhouse units saw significant increases, with 13.9% and 49.8% rises, respectively. This surge provides more options for prospective homebuyers.

- New Listings: There’s been an uptick in new listings, with single-family home listings increasing by 15.3% and townhouse and condo listings by 25.9%, contributing to the growth in inventory levels across the state.

Market Outlook and Trends:

- Statewide Home Value: As of the end of 2023, the average home value in Florida stands at $389,325, reflecting a 2.0% increase over the past year.

- Sale-to-List Ratio: The median sale-to-list ratio in Florida is 0.977, indicating a competitive market.

- Sales Over and Under List Price: In November 2023, 14.5% of sales exceeded the list price, while 67.9% sold below it, suggesting a mix of competitive and negotiable market conditions.

- Market Forecast: The market is expected to grow, with a projected modest but positive growth of +0.7%. The inventory levels for single-family homes have a 3.7-month supply, showing a 32.1% increase year-over-year, and condo-townhouse units have a 5-month supply, up by 85.2% from the previous year.

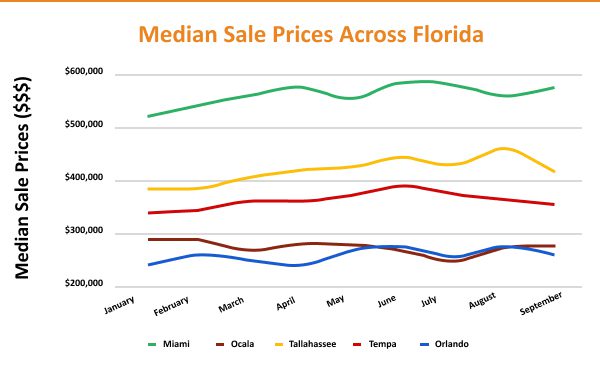

Regional Highlights:

Areas of Significant Growth: Certain areas in Florida are anticipated to experience significant home price increases in 2024, with cities like Clewiston and Wauchula leading the way in projected growth.

The Real Estate Landscape In Florida

21.78 million

Population

$409,243

Median Rent Price

(Single-Family Home)

$387K

Median Home Sold Price

13.07%

1-Year Appreciation Rate

$67,917

Median Household Income

32,615

New Listings

Just Funded Projects

March 2026

Fix & Flip

Loan Amount

$249,520

After Repair Value$420,000

Purchase Price$220,000

Renovation Budget$51,520

Loan TypeFix & Flip

- After Repair Value$420,000

- Purchase Price$220,000

- Renovation Budget$51,520

- Loan TypeFix & Flip

Atlanta, GA

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

Testimonials

What Our Client Say

Just completed my mortgage refi with Insula, and I couldn’t be happier! Bruce, my lender, was absolutely fantastic—professional, responsive, and made the entire process smooth and stress-free. Highly recommend Insula and Bruce for anyone looking to refinance!

Beothie Josue

Sherryl Delisser

Richard Legemah

Brett Riggins

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Invest in Florida’sReal Estate Market?

Florida’s real estate market is a beacon of opportunity, melding affordability, economic vigor, and an exceptional quality of life. This combination positions the Sunshine State as an alluring destination for investors and families alike.

Economic Diversity and Job Growth:

Florida’s economy is robust and multifaceted, driven by industries like tourism, agriculture, and aerospace. This diversity fosters a resilient job market, attracting professionals from various sectors. Such economic strength translates into a rising demand for both residential and commercial real estate, supporting an upward trajectory in property values.

Favorable Business Environment:

The state’s business-friendly climate, marked by advantageous tax policies and incentives, enhances the appeal for investors. Florida’s commitment to fostering a conducive environment for business growth significantly contributes to the attractiveness of its real estate market.

Educational Excellence and Infrastructure Development:

Florida’s investment in education and infrastructure, including top-tier universities and a well-developed transportation network, lays the groundwork for sustainable growth in the property sector. This focus on foundational development ensures long-term benefits for real estate investments.

Diverse Living Options:

Florida offers a spectrum of living experiences, from the vibrant urban life in cities like Miami and Orlando to the tranquil coastal retreats in the Keys. Each area in Florida has its unique charm, catering to various lifestyles and preferences. Urban centers like Tampa and Jacksonville are known for their dynamic growth, while areas like Naples and Sarasota attract those seeking a blend of luxury and tranquility.

Strategic Positioning:

Florida’s strategic location, serving as a gateway to both the domestic and international markets, especially Latin America, adds to its investment appeal. The state’s ports and airports facilitate global trade and tourism, further boosting the real estate sector.

Tourism and Lifestyle:

The state’s renowned tourism industry, bolstered by world-famous attractions, beautiful beaches, and year-round sunshine, drives a consistent influx of visitors and new residents. This continuous flow contributes to a robust demand in the housing market, particularly in areas known for vacation rentals and second homes.

Long-Term Investment Potential:

Investing in Florida’s real estate is not merely about acquiring property but tapping into a growing and diversifying region. The state’s economic resilience, combined with its lifestyle appeal and ongoing development, presents a compelling case for both immediate gains and long-term property appreciation.

With its blend of economic stability, growth potential, and diverse living options, Florida’s real estate market offers an attractive landscape for investors seeking both short-term profits and long-term asset growth.

Ready to apply for a New Construction loan?

Frequently Asked Questions

Our new construction loan in Florida carries a term of 1 year.

No. We also offer construction loans for multifamily, mixed-use and residential rental properties, and fix & flip financing.

You can contact us or apply via the application forms on our website.

Get in Touch with Your Reliable Lenders Today!

If you’re ready to consult with us, give us a call! Our operating hours are from 9 am to 5 pm on every business day. If you want to go through our portfolio, there are details about our recently-funded projects on our website!

Don’t hesitate to reach out for personalized advice tailored to your financial needs. Our team is dedicated to providing you with the insights and support you require for your real estate ventures.

Remember, your investment journey is just one call away, and we’re here to guide you every step of the way!