Rental Property Loans in Texas

Unlock the potential of your real estate investments with rental property loans in California from Insula Capital Group. We are a trusted private money lender specializing in providing fast, flexible financing tailored to meet the needs of property investors. Whether you’re expanding your portfolio, purchasing a new rental property, or refinancing an existing asset, we deliver solutions designed to help you grow.

Our rental property financing offers competitive terms and streamlined approvals, ensuring you can capitalize on opportunities without the lengthy delays of traditional lending. With years of experience in private money lending, our team understands the complexities of the real estate market and works closely with you to structure financing that aligns with your goals.

Contact us today to learn more about our rental property loans in California and get the financial support you need for your next investment.

Get in Touch

Here's Why You Should Be Working With Our Expert Rental Property Loan Brokers!

When it comes to securing a rental property loan in Texas, partnering with experienced professionals is essential to your success. At Insula Capital Group, our expert loan brokers bring years of industry knowledge and a deep understanding of the Texas real estate market. With our guidance, you’ll gain access to private lending options designed to match your investment goals, ensuring faster and more efficient financing.

What sets our loan brokers apart is their dedication to providing personalized solutions. We know that every investor’s situation is different, which is why we tailor our loans to fit your unique needs. From evaluating your property’s potential to securing competitive rates, our team is with you at every step. Plus, our streamlined process means less paperwork, quicker approvals, and more time for you to focus on your investments.

As Texas continues to attract renters and investors alike, having a reliable lending partner can make all the difference. Whether you’re investing in Austin’s growing market or expanding into Houston’s rental scene, our brokers are here to provide the support and expertise you need to thrive in this booming real estate environment. Let us help you take your rental property investments to new heights!

What Makes Rental Property Loans the Perfect Choice for You?

Rental property loans offer unique advantages for real estate investors, especially in a high-demand market like Texas. Whether you’re a seasoned investor or just starting, these loans are designed to help you build long-term wealth through rental income and property appreciation.

One key benefit of rental property loans is their flexibility. With customized terms, investors can secure financing that aligns with their cash flow needs and investment strategies. Unlike traditional loans, rental property loans often feature faster approval times and fewer restrictions, making it easier to seize opportunities in Texas’ competitive real estate market.

Additionally, rental property investments provide a steady income stream. Texas cities like San Antonio and Dallas continue to experience population growth, driving demand for rental properties. By leveraging a rental property loan, you can take advantage of this growing market and generate consistent rental income, while also benefiting from potential property value appreciation over time.

Choosing a rental property loan in Texas is not just about financing—it’s about positioning yourself for financial success. With the right loan, you’ll have the resources to grow your portfolio and maximize your returns in one of the hottest real estate markets in the country.

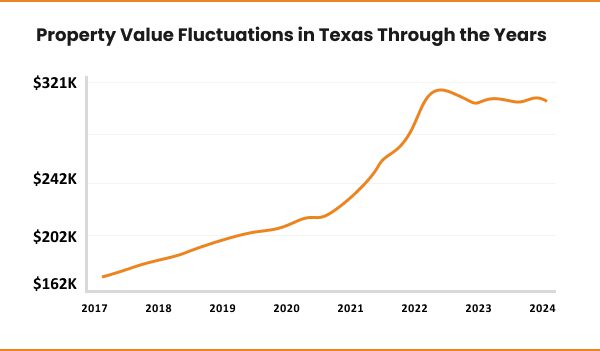

Statistics for Rental Properties in Texas

Don’t make a single monetary commitment until you have taken a look at these stats for real estate performance in Texas:

- The Price to Rent Ratio is 17.0

- The Median Rent Price is $1904.

- The appreciation on properties in the last one year were 2.79%

Rental Property Investment Statistics for Texas

30.03 million

State Population

$1904

Median Rent Price

2.79%

1-year Property Appreciation

$379,000

Median Property Price

17.0

Price-To-Rent Ratio

Just Funded Projects

February 2026

Fix & Flip

Loan Amount

$248,869

After Repair Value$409,000

Purchase Price$145,000

Renovation Budget$147,787

Loan TypeFix & Flip

- After Repair Value$409,000

- Purchase Price$145,000

- Renovation Budget$147,787

- Loan TypeFix & Flip

Decatur, GA

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Unlocking Texas' Real Estate Potential with Insula Capital Group

As one of the fastest-growing states in the U.S., Texas offers significant opportunities for real estate investors. With major cities like Austin, Dallas, and Houston experiencing rapid population growth, the demand for rental properties has surged. This dynamic market presents a lucrative chance for investors looking to capitalize on rental income.

Insula Capital Group specializes in providing rental property loans in Texas, helping investors secure the funding needed to tap into these thriving markets.

Why Invest in Texas Rental Properties?

Texas boasts a rental vacancy rate of around 6%, lower than the national average, making it a hotspot for steady rental demand. Whether you’re investing in single-family homes or multi-unit properties, our tailored lending solutions offer the flexibility you need to grow your portfolio.

Secure Your Investment with Insula Capital Group

At Insula Capital Group, we understand the local market’s intricacies and provide competitive financing to ensure your investments succeed. Let us help you explore Texas’ real estate markets and seize the rental property potential they offer.

Partner with Insula Capital Group and start building wealth through smart, well-funded investments in Texas’ booming real estate sector.

Ready to apply for a rental property loan?

Frequently Asked Questions

Insula Capital Group offers flexible loan options for single-family homes, multi-unit properties, and other rental investments in Texas. Our loans are designed to meet the unique needs of real estate investors, helping them grow their portfolios quickly and efficiently.

With our streamlined approval process, you can secure financing in as little as a few days, allowing you to move fast in Texas’ competitive real estate market. We prioritize quick and efficient funding to help you capitalize on opportunities.

Contact Insula Capital Group for High Yielding Rental Property Loans in Texas!

Thinking about making some money with Texas’ booming real estate dynamics? At Insula Capital Group, we understand that making profitable financial decisions for yourself is crucial, which is why we aid your search for financial backing with our rental property loans!

Our services cover a range of loan types that can help you make smart investments, which include the following:

- Fix & Flip Financing

- Residential Rental Program

- New Construction Loans

- Hard Money Loans

- Multifamily Mixed Use

- Commercial Property Loans

- Investment Property Loans

- Rental Property Loans

Don’t delay your chances at making it big – get in touch with our representatives between 9AM and 5 PM to get smart and fast private lending services with Insula Capital Group today!

Investing in rental properties can be a highly profitable venture, but it requires the right financial partner to help you navigate the process. Insula Capital Group specializes in offering private money lending services, providing customized rental property loansdesigned to suit your unique investment goals.

Our experienced team understands the complexities of acquiring rental property financing, and we are committed to offering streamlined loan solutions that are tailored to meet the needs of real estate investors. Whether you’re expanding your rental portfolio or looking to finance a new project, we provide expert guidance and flexible lending options.

With our team by your side, you can confidently secure the rental property loans you need in California. Reach out to Insula Capital Group today and take the next step toward a successful investment future!