Private Money Lenders | Hard Money Loans in New Jersey

The Garden State is rich in many wonders of the man-made and natural variety. From peaceful state parks to bustling towns, there’s so much that makes New Jersey stand out.

However, investors are familiar with New Jersey for its thriving real estate market. The state runs sprawling suburban properties, beach houses, modest apartments, and homes. Permits for new constructions and flipped properties are also easy to obtain.

Despite the small size, the state boasts an array of lucrative investment opportunities that you can easily leverage with quick and convenient hard money loans acquired through Insula Capital Group. Find out more about our asset-based financing options here.

Get Exceptional Hard Money Financing Services In New Jersey

With over three decades of experience, our private money lenders understand the fast-paced nature of the real estate industry. That’s why we offer speedy approvals, competitive rates, and personalized loan programs to our clients.

We help investors with different types of property investment, including those associated with new construction loans, fix & flip financing, multifamily mixed-use loans, and residential rental loans.

Whether you’re a seasoned investor or a first-time borrower, our team is here to provide guidance and help you make informed financial decisions. With no pre-payment penalties or hidden fees, our transparent approach sets us apart. Apply now through our easy online application.

Jumpstart Your Real Estate Projects With Hard Money Loans

Opting for hard money loans in New Jersey for real estate projects can be an excellentchoice. New Jersey has a fast-paced property market that requires swift financial solutions, and hard money loans are the perfect option because of rapid approval processes.

Private money lenders have easy lending criteria and a quick underwriting process to offer hard money loan approvals. Whether you want to purchase a commercial property before your competitors get their hands on it or you’ve got your eyes set on a beautiful house, hard money loans can help you buy the property you need.

Hard money lenders can also customize loan terms to fit the specific needs of your project. From flexible repayment terms to low interest rates, you can get various benefits when opting for hard money financing.

Even if you’ve got a low credit score, you can still expect to get a hard money loan approval since private lenders focus on your collateral’s value. This makes hard money loans an exceptional option for individuals with a poor credit history.

If you want to dive into the competitive real estate market in New Jersey, connecting with a private lender that offers hard money loans is necessary.

Everything You Need To Know About New Jersey's Real Estate Environment

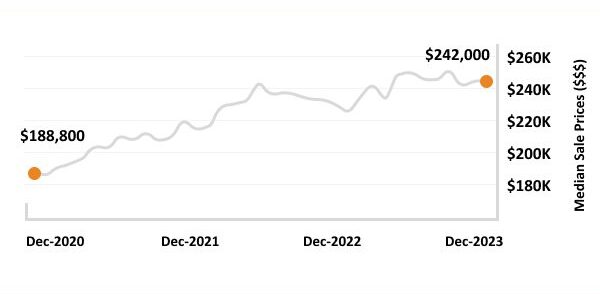

Investing in the real estate market without proper research is a rookie mistake. If you want to make an informed decision about purchasing a property in New Jersey, here are some statistics that might be helpful for you:

- Median Home Value: $470,843

- Median Sales Price: $510,000

- 1-Year Appreciation Rate: +14.1%

- Homes For Sale: $18,145

- Median Rent Price: $1,835

- Price-To-Rent Ratio: 38

- Unemployment Rate: 9%

- Population: 9,267,130

- Median Household Income: $85,245

- Foreclosure Rate: One in every 2,564 housing units

The Real Estate Landscape In New Jersey

9,267,130

Population

$85,245

Median Household Income

$1835

Median Rent Price

$470,843

Median Home Value

21.38

Price-To-Rent Ratio

1/2564

Foreclosure Rate

Just Funded Projects

January 2026

Fix & Flip

Loan Amount

$259,515

After Repair Value$360,000

Purchase Price$235,000

Renovation Budget$48,015

Loan TypeFix & Flip

- After Repair Value$360,000

- Purchase Price$235,000

- Renovation Budget$48,015

- Loan TypeFix & Flip

Wilmington, NC

January 2026

New Construction

Loan Amount

$835,100

After Repair Value$1,193,000

Purchase Price$425,000

Renovation Budget$576,221

Loan TypeNew Construction

- After Repair Value$1,193,000

- Purchase Price$425,000

- Renovation Budget$576,221

- Loan TypeNew Construction

Miller Place, NY

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$920,000

Loan TypeResidential Rental Program (Buy & Hold)

- Loan TypeResidential Rental Program (Buy & Hold)

Jamaica, NY

January 2026

New Construction

Loan Amount

$236,210

After Repair Value$365,000

Purchase Price$256,233

Renovation Budget$39,000

Loan TypeNew Construction

- After Repair Value$365,000

- Purchase Price$256,233

- Renovation Budget$39,000

- Loan TypeNew Construction

Lakeland, FL

January 2026

Residential Rental Program (Buy & Hold)

Loan Amount

$165,750

Purchase Price$207,187

Loan TypeResidential Rental Program (Buy & Hold)

- Purchase Price$207,187

- Loan TypeResidential Rental Program (Buy & Hold)

Memphis, TN

December 2025

Fix & Flip

Loan Amount

$838,500

After Repair Value$1,129,000

Purchase Price$765,000

Renovation Budget$150,000

Loan TypeFix & Flip

- After Repair Value$1,129,000

- Purchase Price$765,000

- Renovation Budget$150,000

- Loan TypeFix & Flip

Bayport, NY

December 2025

Fix & Flip

Loan Amount

$1,841,503

After Repair Value$2,825,000

Purchase Price$755,500

Renovation Budget$1,410,975

Loan TypeFix & Flip

- After Repair Value$2,825,000

- Purchase Price$755,500

- Renovation Budget$1,410,975

- Loan TypeFix & Flip

Saddle River, NJ

December 2025

Fix & Flip

Loan Amount

$617,500

After Repair Value$1,065,000

Purchase Price$570,000

Renovation Budget$109,725

Loan TypeFix & Flip

- After Repair Value$1,065,000

- Purchase Price$570,000

- Renovation Budget$109,725

- Loan TypeFix & Flip

Gallatin, TN

December 2025

Fix & Flip

Loan Amount

$1,964,379

After Repair Value$3,000,000

Purchase Price$1,666,025

Renovation Budget$598,238

Loan TypeFix & Flip

- After Repair Value$3,000,000

- Purchase Price$1,666,025

- Renovation Budget$598,238

- Loan TypeFix & Flip

Sag Harbor, NY

December 2025

Fix & Flip

Loan Amount

$171,250

After Repair Value$263,000

Purchase Price$125,000

Renovation Budget$65,000

Loan TypeFix & Flip

- After Repair Value$263,000

- Purchase Price$125,000

- Renovation Budget$65,000

- Loan TypeFix & Flip

Albany, NY

December 2025

New Construction

Loan Amount

$650,000

After Repair Value$1,200,000

Purchase Price$500,000

Renovation Budget$606,950

Loan TypeNew Construction

- After Repair Value$1,200,000

- Purchase Price$500,000

- Renovation Budget$606,950

- Loan TypeNew Construction

Fulton, NY

What we offer

All Loan Services

Fix And Flip Loans

Fix And Flip Loans

Ground Up Construction

Ground Up Construction

Rental Property Loans

Rental Property Loans

Why Is Investing In The New Jersey Real Estate Market A Lucrative Option

New Jersey’s real estate market is booming because of its strategic location between major areas like New York and Philadephia. The accessibility to such metropolitan areas attracts top talent from all over the US and takes the real estate demand to new heights.

The flourishing job market in New Jersey leads to a steady demand for residential and commercial properties. The state’s focus on infrastructure development also enhances the overall quality of life, attracts more residents, and boosts real estate demand.

With rising real estate prices across the state, purchasing properties quickly can help you earn hefty profits in the future. However, we understand that purchasing a property can become a financial burden on you. This is why we provide viable hard money financing solutions for our clients. Whether you need financing for a fix & flip project or a construction venture, our team is here to help you at every step and turn your financial dreams into a reality.

Ready to apply for a money lenders loan?

Get in touch with our experienced team for more details about our financing services.

Frequently Asked Questions

Getting a hard money loan from private money lenders is fairly simple. While traditional lenders require good credit scores and income verification, we prioritize your property value, your overall plan, and your exit strategy. If you’re unsure about eligibility, discuss your financial situation with one of our team members.

Having prior real estate experience can be very advantageous, but it’s not a strict requirement if you’re working with us here at Insula Capital Group. Having three projects on your portfolio or some sort of relevant experience is preferred. While traditional lenders require good credit scores and income verification, we prioritize your property value, your overall plan, and your exit strategy.

You can start our full loan application online or explore further to learn whether you can pre-qualify now!

Connect With Reliable Hard Money Lenders in New Jersey

At Insula Capital Group, we prioritize fast approvals, competitive rates, and exceptional customer service.Our team at will analyze your financial needs and provide customized hard money loan deals. Our loans have various features, including quick approvals, no junk fees, minimal paperwork, no pre-payment penalties, and much more.

Check out our loan programs and just-funded projects for better insights and inspiration!

Top Hard Money Lenders Loan Cities in New Jersey

Connect With Reliable Hard Money Lenders in New Jersey

At Insula Capital Group, we prioritize fast approvals, competitive rates, and exceptional customer service. Our team will analyze your financial needs and provide customized hard money loan deals. Our loans have various features, including quick approvals, no junk fees, minimal paperwork, no pre-payment penalties, and much more.

Check out our loan programs and just-funded projects for better insights and inspiration!